Deciding whether to rent or buy a home is a significant financial and lifestyle decision. While renting may feel simpler in the short term, homeownership has long been recognized as one of the most effective ways to build wealth. Recent data from the Federal Reserve’s Survey of Consumer Finances (SCF) highlights just how stark the difference is between the financial outcomes of homeowners and renters.

The Net Worth Gap: Homeowners vs. Renters

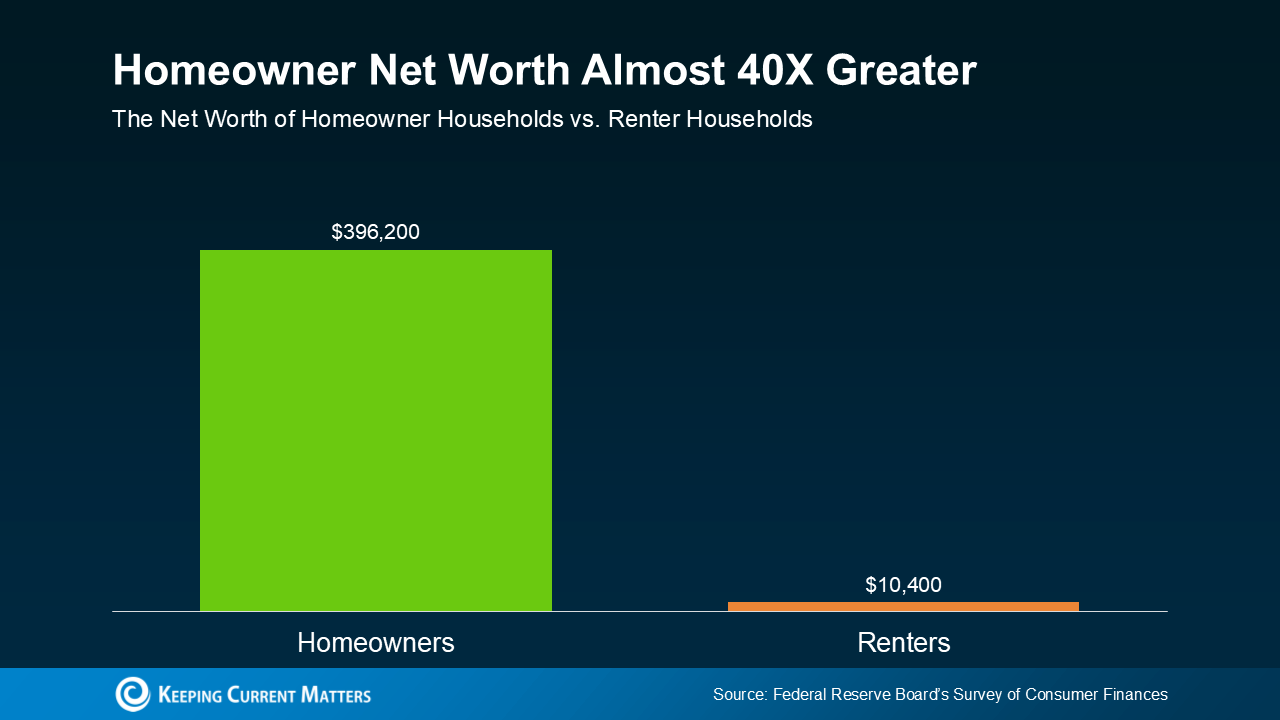

The Federal Reserve’s SCF, released every three years, provides a detailed snapshot of household finances across the country. The latest report reveals that the average net worth of homeowners is a staggering $396,200, while renters lag far behind at just $10,400. This means that, on average, homeowners enjoy a net worth nearly 40 times greater than renters.

Take a look at the chart below for a visual representation of this wealth gap:

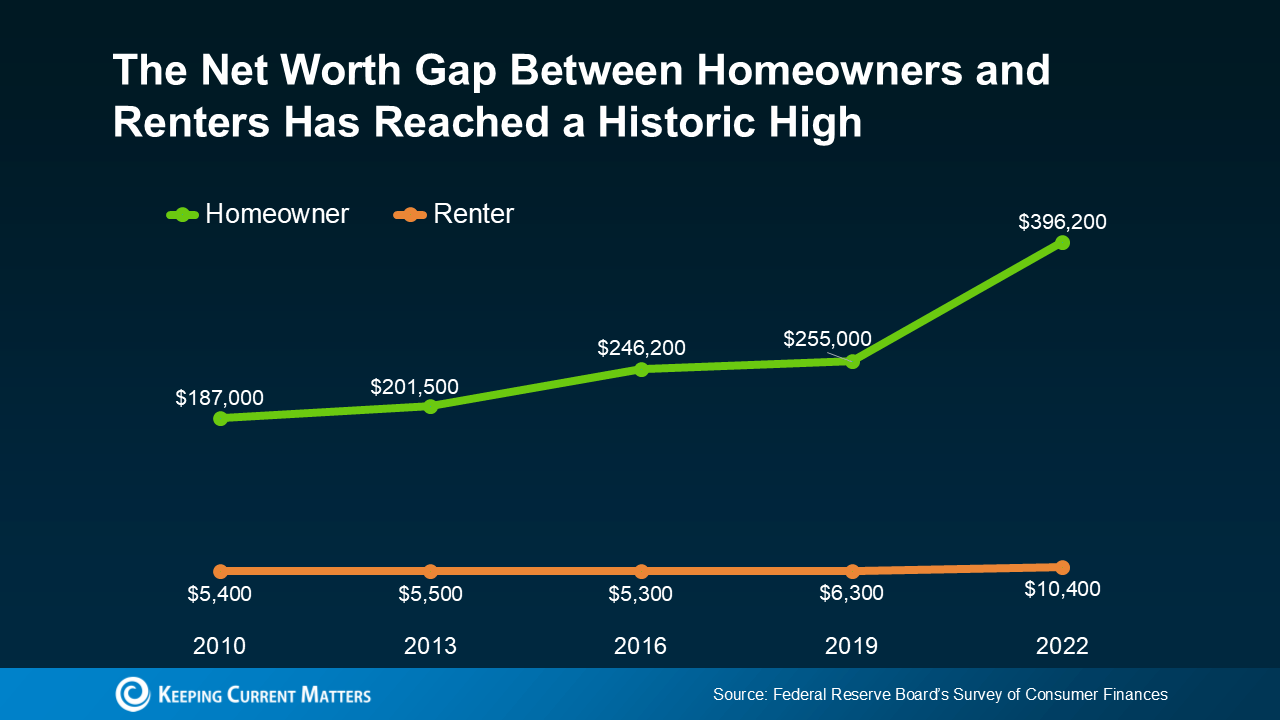

This disparity didn’t appear overnight. It has grown steadily over the years, as demonstrated in the second chart:

Between 2019 and 2022, homeowner net worth experienced its largest three-year increase in the history of the SCF. Median net worth during this period more than doubled, illustrating just how much financial value owning a home can provide.

Why Homeownership Builds Wealth

The key driver behind this dramatic increase in homeowner wealth is home equity. Home equity represents the difference between your home’s current market value and the balance of your mortgage. Equity grows in two primary ways:

- Paying Down Your Mortgage: Every monthly payment you make reduces the amount you owe, steadily increasing your ownership stake in the property.

- Home Value Appreciation: When home prices rise, so does the value of your equity.

Over the past few years, home values have risen sharply due to limited housing inventory and high demand. This supply-demand imbalance fueled rapid appreciation, allowing homeowners to build equity faster than in typical market conditions.

As the Federal Reserve notes:

“The 2019-2022 growth in median net worth was the largest three-year increase over the history of the modern SCF, more than double the next-largest one on record.”

Even though the pace of price appreciation has slowed in 2024 compared to the pandemic years, many experts forecast continued, albeit more moderate, home price growth in 2025. This means that buying a home today still offers the potential for future equity gains.

Renting vs. Buying: What’s the Best Choice for You?

Deciding between renting and buying involves more than just comparing monthly costs. While renting may offer flexibility and fewer upfront expenses, it does little to build long-term financial security. By contrast, homeownership provides not only a place to live but also a pathway to wealth accumulation.

As Ksenia Potapov, an economist at First American, explains:

“Despite the risk of volatility in the housing market, homeownership remains an important driver of wealth accumulation and the largest source of total wealth among most households.”

Factors to Consider When Buying

While the financial benefits of homeownership are compelling, your decision should also account for your personal circumstances and goals. Here are some factors to weigh:

- Local Market Trends: Home prices and inventory levels vary by region. In many areas, limited inventory continues to put upward pressure on prices. Partnering with a knowledgeable local real estate agent can help you navigate these nuances.

- Long-Term Financial Goals: Homeownership is a long-term investment. Consider whether you’re ready to commit to staying in one place for at least a few years to reap the benefits of appreciation and equity growth.

- Available Assistance Programs: If affordability is a concern, there are various programs available for first-time buyers, such as down payment assistance and low-interest loan options.

As Bankrate advises:

“Deciding between renting and buying a home isn’t just about cost — the decision also involves long-term financial strategies and personal circumstances. If you’re on the fence about which is right for you, it may be helpful to speak with a local real estate agent who knows your market well.”

The Bottom Line

Homeownership isn’t just about having a roof over your head—it’s a wealth-building strategy that can significantly impact your financial future. While renting may feel like a simpler choice, it doesn’t offer the same opportunities to grow your net worth over time.

If you’re considering buying a home but feel uncertain about whether it’s the right move, reach out to a trusted mortgage advisor and real estate agent. They can help you evaluate your options, explore assistance programs, and create a plan tailored to your financial goals.

By taking the leap into homeownership, you’ll not only secure a place to call your own but also set yourself on a path to greater financial stability and opportunity.