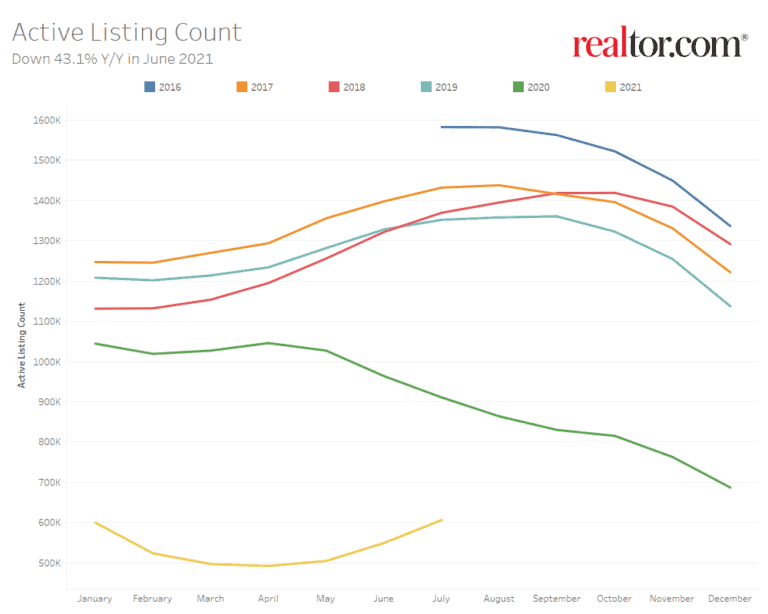

The housing market has seen a fight for available homes from buyers all over the nation. The limited number of homes on the market put a persistent strain on buyers all year. A national effort on infrastructure is needed to support a higher level of home starts and getting housing supply to the place it needs to support demand. However, indications show that available inventory is already increasing.

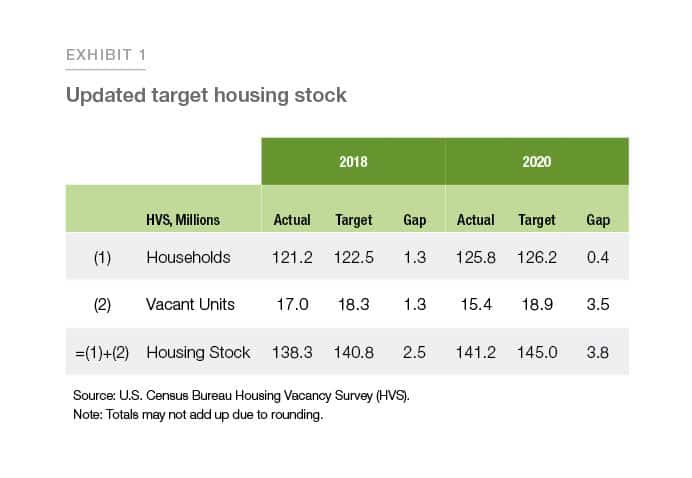

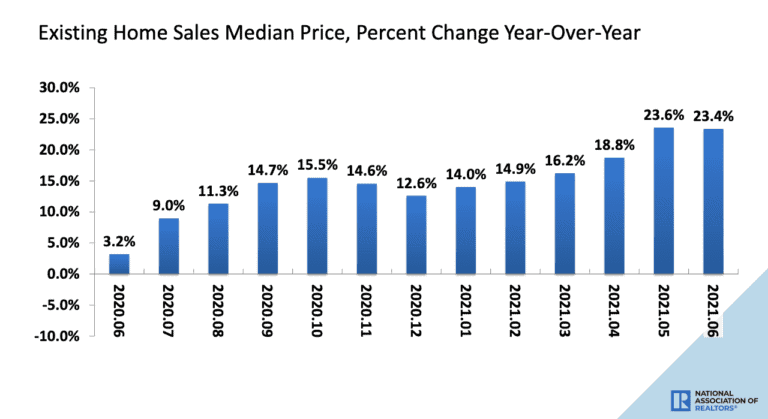

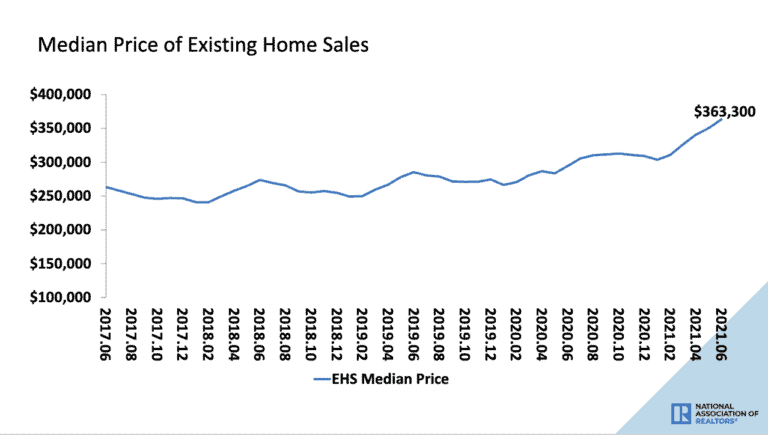

Single-family and new home construction have been on the decline for years. It has caused short-term and long-term effects on the market and economy. Low inventory and underbuilding play a much larger part in society than we think. The NAR released a study titled, Housing is Critical Infrastructure: Social and Economic Benefits of Building More Housing. In the last two decades, the gap between demand and supply has significantly widened. Inflation to consumer goods, rent prices, lumber and materials costs, resources for local communities, and economic infrastructure are affected by this widened gap creating rapid home price growth, which outweighs wage growth and, in turn, reduces affordability for home buyers. According to the NAR, the median existing-home sales price rose at a year-over-year pace of 23.4 percent, the second-highest level recorded since January 1999. At the end of 2020, Freddie Mac showed that the housing supply was almost 4 million units short needed to meet the demand.

“. . . the underbuilding gap in the U.S. totaled more than 5.5 million housing units in the last 20 years. Looking ahead, to fill an underbuilding gap of approximately 5.5 million housing units during the next 10 years, while accounting for historical growth, new construction would need to accelerate to a pace that is well above the current trend, to more than 2 million housing units per year. . . .”

The market is feeling the effects most dramatically this year. Concerns of a market crash have weighed on the decision to buy or sell for consumers. There has been an ongoing industry debate about whether we are in a housing bubble and if it will burst, plus how long the inventory crisis will continue.

“…there are still concerns that the hot market might create problems that stunt the economic recovery or spill over into other sectors. Some economists worry that housing may become a major driver of inflation, which could push up prices on all consumer goods. Others say sky-high home prices will exacerbate inequality by making it impossible for first-time buyers to become homeowners, which could cost the millennials their best opportunity to generate wealth in their prime earning years. Rising home prices also mean higher rents, which hold back lower-income Americans and can contribute to homelessness. For these reasons, some experts are calling on the Federal Reserve to raise interest rates and throttle back its bond purchase to cool down the housing market.” – Yahoo News

On the other hand, some experts have been focusing on the stability of the current housing market. The consistent growth represents resilience not only from The Great Recession but the year through the pandemic alone.

It is important to consider the bigger picture. How do we improve? While new construction is on the upswing, more existing homes need to enter the market. It could take up to 10 years or more to help close the underbuilding gap and supply shortage. However, the outlook is positive, which means you might not have missed out on the opportunity to buy.

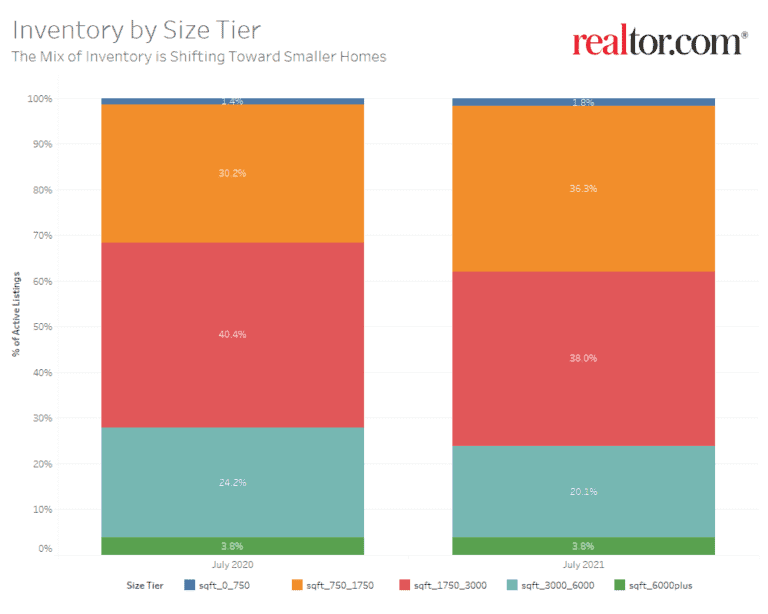

In July, Realtor.com reported that newly listed homes on the market were up 6.5% nationally compared to a year ago and 11.1 percent higher for large metros over the past year. This uptick is good news since the Summer months tend to see fewer listings than the Spring market. At first, new construction and listed homes were expanding on the higher-end market. The shift is starting to happen for smaller starter homes. For single-family-sized homes, newly listed homes increased from 30.2 percent in July 2020 to 36.3 percent in July this year. Great news for first-time buyers and millennials eager to buy a house.

Overall, the monthly supply of homes in the U.S. rose to 6.3 months worth in June, making it the highest level since April 2020. Looking forward, the monthly supply of homes will see a steady uptrend. More existing homes are expected to enter the market in parallel to new home construction.

For buyers, competition is slowing, and mortgage rates are expected to rise, which will help to balance home prices. For sellers, supply is still at historic lows, which can help you get the best deal possible. If you have waited on the sidelines to buy or sell, take the next step, and let’s talk about your goals.

This article is intended to be accurate, but the information is not guaranteed. Please reach out to us directly if you have any specific real estate or mortgage questions or would like help from a local professional. The article was written by Sparkling Marketing, Inc. with information from resources like NAR, Realtor.com, and Freddie Mac.