As we move into the last quarter of the year, real estate professionals are aware the market is still capable of surprises. There seems to be no sight of the sprint dying down any time soon. Many believe the market is on its way back to pre-pandemic levels. While it is difficult to predict anything these days, the housing sector has changed in many ways and possibly for good.

In short, mortgage rates stay low, around a three percent average through to the end of the year providing purchase leverage for potential buyers. Home appreciation is looking to hit a high of over 14 percent this year for homeowners. Available homes for sale are less than half the number of what tends to be a normal range. Offers are still in multiples on homes, and selling a home takes half the time of what used to be considered normal. Will we ever get used to this new normal? What do experts predict for the rest of 2021? What is the outlook for 2022?

HOUSING PRICES

Home prices grew over 24 percent since the start of the pandemic. As of September, price appreciation has steadied. Median existing-home sales price up 15 percent from one year ago. Nationally, the median list price jumped from $310,000 (February 2020) to $385,000 (June 2021). On a regional level, those prices surged even higher. Those with the ability to continue working from home fled to the suburbs or low-cost states. For instance, Idaho had the highest increase at 46 percent, and Boise’s median home list price saw a 42 percent climb to $536,600. Realtor.com found that Montana, Maine, Connecticut, Utah, and California were among the highest price growth with a 30 percent increase or more.

Signs of a cooling market began over the summer. Buyer fatigue heightened as prices continued to soar, and the bidding wars persisted. Realtor.com showed “nationally, the inventory of homes actively for sale in August decreased by 25.8 percent over the past year, a lower rate of decline compared to the 33.5% drop in July.” Though this shows signs of a positive direction for active listings, supply remains at historic lows.

Home prices may level out or slow their pace during the fall season. Due to buying demand remaining beyond tight inventory, home prices will see a slight increase before they decrease. Experts at CoreLogic predict prices will rise another 3 percent within the next 12 months.

INVENTORY

After numerous headlines displaying the lack of inventory, numbers are finally on the uptick. August marked the fourth month in a row for inventory levels to grow. According to Zillow, more than 1.1 million homes were for sale in August, up 4.1 percent from July.

“While August marked the fourth consecutive month of national inventory improvements from the steepest 2021 declines seen in April (-53.0%), the U.S. housing supply is still short 223,000 active listings compared with last year. Inventory was improving at a faster pace across the 50 largest U.S. markets in August, down an average 20.7% year-over-year…” – Realtor.com

Inventory levels are still lacking overall. Active listings on a national level are still down by about 26 percent.

Some buyers had been forced out of the market as entry-level homes became less available. New construction for entry-level homes has been a long-winded issue for decades, but finding any starter home seems more impossible today. Experts call for the market to be more buyer-friendly come 2022, as slight increases in entry-level homes continue to arrive on the market.

“In 1982, 40% of the country’s newly constructed houses were entry-level homes. By 2019, the annual share had fallen to around 7%.” – NPR

“Additionally, 432,000 new listings hit the national housing market in August, an increase of 18,000 over last year. Continuing last month’s trend, more new sellers added to the share of entry-level homes (+6.4%), defined as single-family homes in the 750-1,750 square foot range, whereas listings with 3,000-6,000 square feet declined 4.6% in August.” – Realtor.com

Any available homes on the market did not last long. On average, homes spent around 39 days on the market. With dire inventory levels, houses for sale were flying off the market within 17 days or less – a new normal that may stick around.

MORTGAGE RATES

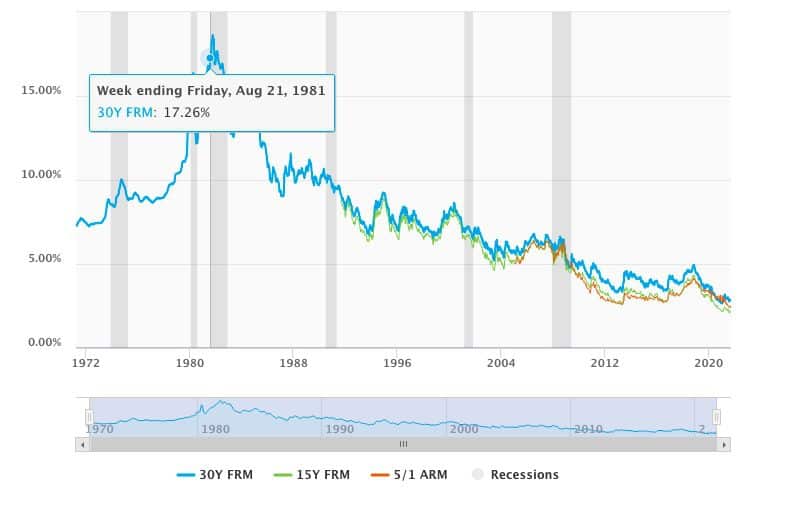

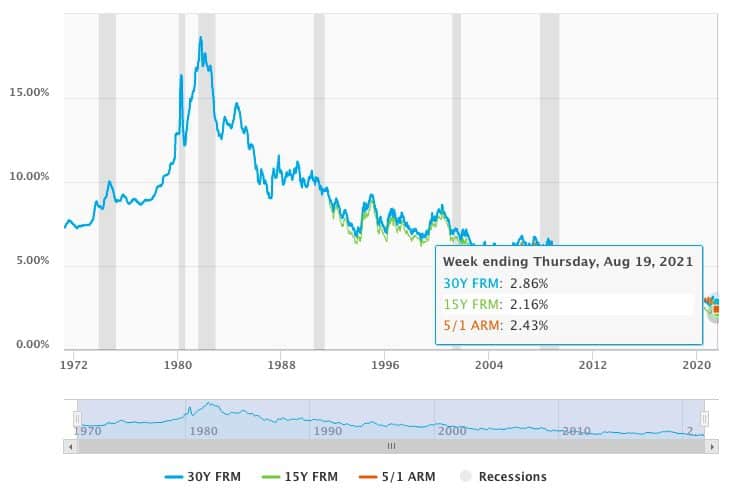

Since the pandemic, the historic lows of mortgage rates continue to be a hot topic. Experts predicted that rates would slowly increase this year. Though there was a slight jump above three percent in the first quarter of the year, rates are back to hovering below, with a 2.78 to 3 percent average.

Many potential buyers continue to take advantage to buy or refinance at a great rate. Freddie Mac and realtor.com forecast rates could increase closer to a 3.6 to 4 percent average by the end of 2022. Looking over the last four decades, Freddie Mac shows how drastically mortgage rates have changed. Rates ranging from 7 to 11 percent in the 1970s and maximizing as high as 18.53 percent in 1981 shows that rates are holding at historic lows.

The housing market has learned a lot can change in one year. It is hard to say what will happen in 2022. Returning to a sense of normalcy may not take any normal route at all.

If you have any questions or want more information on how to be prepared, reach out.

This article is intended to be accurate, but the information is not guaranteed. Please reach out to us directly if you have any specific real estate or mortgage questions or would like help from a local professional. The article was written by Sparkling Marketing, Inc. with information from resources like NAR, Freddie Mac, CoreLogic, and Realtor.com