Top 5 Things to Know Before Entering The Real Estate Market Today

As the demand for houses supersedes supply, the prices naturally continue to rise as well.

"*" indicates required fields

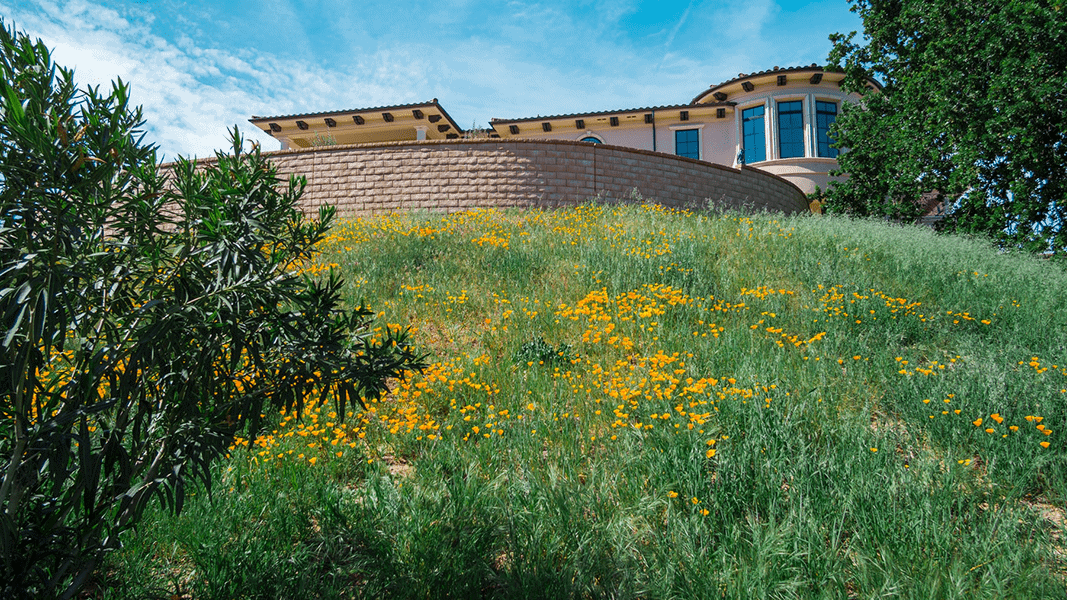

Learn more about Memphis real estate.

As the demand for houses supersedes supply, the prices naturally continue to rise as well.

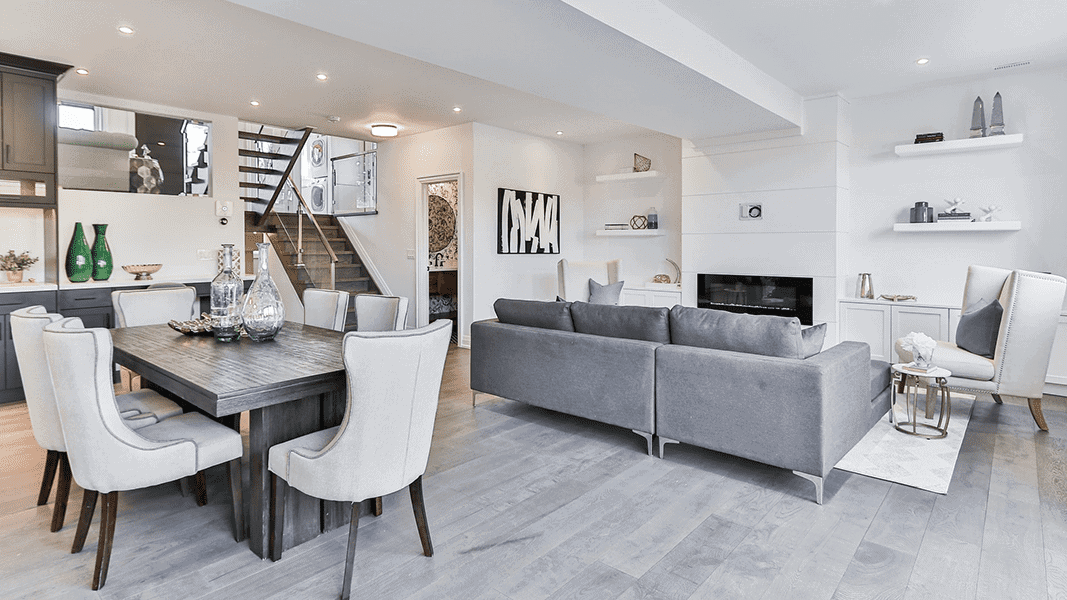

When considering what is most important to you, making a list of priorities can be extremely helpful.

Today, almost every sector has enhanced its user experience with technology and digital resources. For the mortgage and real estate industries, adapting to the changes with technology was a must. Technological advances, the convenience of digital tools, and mobile apps have increasingly gained momentum over the last few years. Since the pandemic in 2020, it became even more apparent that FinTech and Digital access for Real Estate is here to stay. Here are some of the most popular and emerging tech tools for 2022. HOMEBUYING MOBILE APPS House hunting has become even easier with apps such as Zillow, Redfin, Realtor.com, and Trulia. Search for available homes, list your home, and learn about the market all on the go. Zillow continues to stand above the rest due to its robust home inventory and additional services. Newer sites like Homesnap may be one of the most interactive tools. You can connect with your spouse, family members or friends to share homes, data, and more through regular messaging making it super easy. It also features a MLS-powered search that is quick to update listings accurately. In todays market, knowing the most recent status of a home is crucial to you winning the bidding

The limits are adjusted every year based on average home prices, which have increased just over 18% this year.

Eric: Hey everyone. Eric Bibel with the Bibel team at NEO Home Loans. I’m here today to talk to you about student loan debt. [Timestamp: 00:15]: If you like the content that you’re seeing here today, please like, subscribe, comment. It helps to ensure that we continue to be able to get our message out. Again, today I want to talk to you about student loan debt. Ton of questions out there, as there should be. Over 45 million Americans in some way, shape or form, have some form of student loan debt. And most importantly, why we want to discuss it is, it can absolutely have impact in your ability to purchase a new home. So historically, looking back to the past, when someone came to us with student loan debt, whatever that payment was, or a factor of the balance would ultimately have impact to your ability to qualify for a new home purchase. Now, if you look at somebody that’s entering, say, the medical field, engineering field, law field, there are some pretty tremendous student loan obligations tied to that, which effectively can be a mortgage, and in turn, really impact your ability to secure a new

Your credit score is an important factor in qualifying for a good mortgage rate. The higher your score, the lower rate you can qualify for. A score of 740 or above is considered excellent, and can help you secure the best rate. A drop of 100 points could cause a drop of 1 percent. This may seem small, but it can add up to a lot of money over time. The good news is, there are steps you can take to control your credit score and make big improvements over time. When it comes to home buying, planning is everything! Why is your credit score an important matter when getting a home loan? Lenders look at your credit score as a way to understand your debt-to-income ratio. This is generated by your credit history, paying your bills on time, and paying off any credit card balances. The number of your credit score is an indication to the mortgage lender how responsible you are to paying back money borrowed. The more likely you are to pay back the lender on time, the higher chance of qualifying for a better rate. Generally, industry professionals consider a score in the 700’s to receive

"*" indicates required fields

"*" indicates required fields