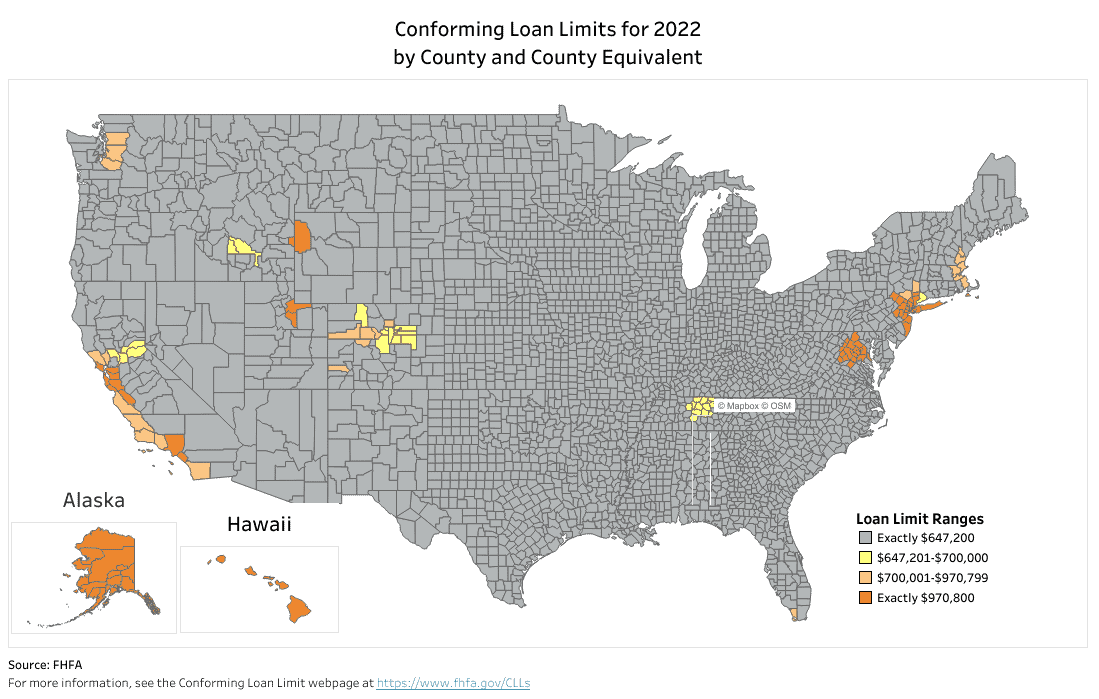

The FHFA announced the conforming loan limits for mortgages acquired by Fannie Mae and Freddie Mac in 2022. The limits are adjusted every year based on average home prices, which have increased just over 18% this year. These vary based on the median home values in each area, but for most of the U.S., the new CLL will be $647,200 for buyers of single-unit homes. This is a $98,950 increase from the $548,250 in 2021.

For areas with higher-cost housing, the limit will be up to $970,800. The new ceiling loan limit is 150 percent of the $647,200. This is the new dividing line between conforming loans and jumbo loans for the major lenders.

If you are a borrower, this is great news! Thankfully, the new limits are in line with home price inflation. You can find out if you are qualify for a conforming loan limit this year. Be sure to contact your trusted mortgage professional for more details. We are always here to answer questions.

Limits vary across the country and cities. You can click here to view a map and find your local county limit.

The Mortgage Reports share a good visual of conventional loan limits to show their growth through the last 4 decades:

*This article is intended to be accurate, but the information is not guaranteed. Please reach out to us directly if you have any specific real estate or mortgage questions or would like help from a local professional. The article was written by Sparkling Marketing, Inc., with information from resources like FHFA, Fannie Mae, Insider.